Banking Basics 💵

About 7 minutes

Okay, chances are you already have some sort of bank account (and hopefully you don’t keep all of your cash in a locked lunchbox). But it can still be a little tricky to keep track of all the different types of accounts out there competing for your hard earned lunch money.

So let’s go over a few of the basics to get you started.

Here’s what we cover in this guide

Checking accounts

Savings accounts

Alternatives to savings accounts

Deposit insurance

Setting up an account

Debit vs credit

Comparing credit cards

Checking Accounts

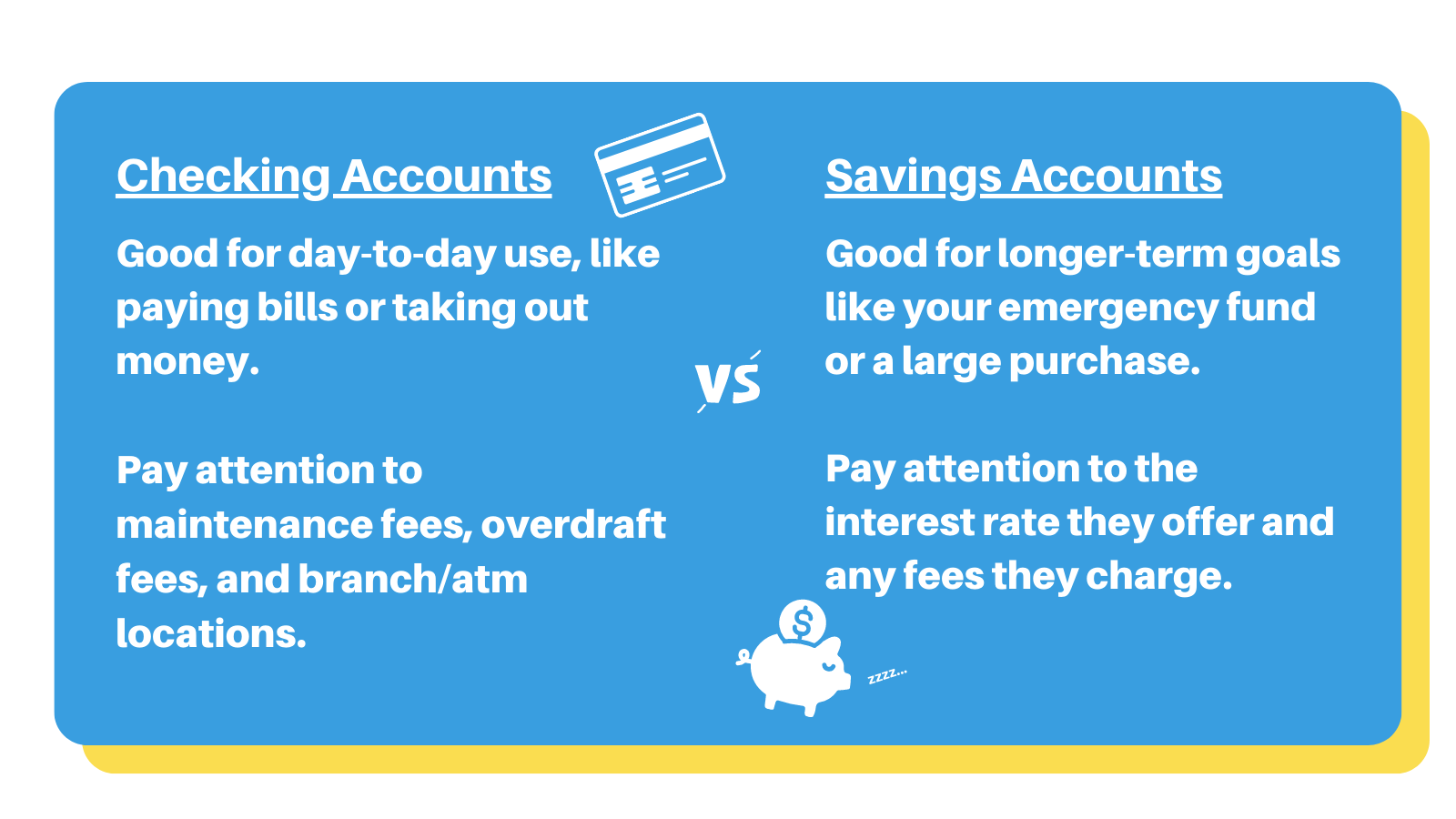

For a lot of people, banking begins with a checking account.

That’s because checking accounts offer security and ease of access to your money. So they’re great for day-to-day spending needs like paying bills or taking out cash.

The main drawback of checking accounts is that they typically pay little or no interest on your money (that’s where a savings account comes in, which we’ll get to next).

Opening an account

When you open a checking account, you’ll usually receive checks (obviously) and a debit or ATM card so you can make payments and take out cash from ATMs, or automated teller machines. Of course you can also still take money out of your account in person at the bank – we know, maybe a little outdated for some of you, but hey, free lollipops!

A few things to pay attention to if you’re shopping around for an account;

• Monthly Fees – Banks will often charge monthly maintenance fees, which can get as high as $10 (or more). Some banks will waive these fees if you meet a minimum balance or other specific requirements. Other banks charge no fees at all, so you’ll want to pay attention when signing up.

• Overdraft Fees – If you sign up for overdraft protection, you can temporarily spend more money than you have in your checking account. While this might seem like a great thing, it comes at a cost, in the form of an overdraft fee. Overdraft fees can be hefty, so make sure you do your research before signing up. And in general, try to avoid overdrawing your account even if you do sign up for protection.

• ATM and bank locations – Most of us are doing more and more of our financial transactions online these days. But it can still be a good idea to have access to ATMs and physical banks. If this is something that matters to you, make sure your bank has locations near you so you won’t be hit with a service charge for using another bank’s ATM. This will usually be several dollars per transaction.

Savings Accounts

Savings accounts are also a great way to keep your money secure. But they have one big advantage over checking accounts – they generally do pay interest on your balance.

This makes them a good place to hold money for long-term goals, like your emergency fund or money you’re putting away for a large purchase down the road.

There is a drawback with savings accounts though. They’re not really intended for day-to-day use. In fact, traditionally, U.S. law limited the number of online withdrawals and transfers you can make with a savings account to six per month. This restriction was actually lifted in 2020 during the pandemic, and seems to be permanent. But some banks still have their own restrictions in place.

Long story short, savings accounts are usually best for those longer-term goals.

Interest rates for savings accounts

In general, banks will vary in terms of what rates they offer. So you’ll want to shop around when you’re choosing an account. And if you already have an account, don’t be afraid to reach out to your bank to see if they’re offering their best rate.

We should mention that in recent years, interest rates have been quite low. So many traditional brick-and-mortar banks have offered fairly low rates on savings accounts. They still offer more than zero, but generally their rates haven’t been too great.

Alternatively, online-only banks have grown in popularity recently and are usually able to offer higher rates by cutting out the overhead costs associated with managing physical branches. So they may be worth considering if you don’t particularly care about having a physical branch or if you’re looking to open a second account.

We have a mini guide if you want to learn more about opening an account.

To recap;

Alternatives to savings accounts

Savings accounts aren’t the only game in town if you want to earn some interest on your cash. Two alternatives you should know about are 1) money market accounts and 2) certificates of deposits. Let’s break them down.

Money Market Accounts

Money market accounts are similar to traditional savings accounts. They also typically offer higher interest than checking accounts, but you may be restricted to a certain number of transactions per month.

Some money market accounts even allow you to write checks too.

The downside with money market accounts is that some banks require higher minimum balances to open one. However, this will vary from bank to bank, so be sure to compare offers.

Terminology Note: A money market account is different from a money market fund, which is a type of short term bond fund you might hold in a brokerage account.

Certificates of Deposit

A CD (Certificate of Deposit) is also a way to save money, but it’s a little different from the accounts we’ve discussed so far. With checking accounts, savings accounts, and money market accounts, you’re generally free to deposit and withdraw money when you want (with some restrictions on the number of transactions for savings and money market accounts).

With a CD, your money is locked up for the term of the CD, a given period of time when you can’t access your money without incurring a penalty. The term can vary, typically from several months to several years, and generally the longer it is, the higher the interest rate you’ll earn.

So if you know you won’t need the money for a while, the higher rates offered on CDs might make them worth it. But remember, you won’t be able to access your money. If you think you may need the money sooner, you’re better off with a savings account or money market account.

Is my money safe at a bank?

For the most part, yes. But it does depend on whether or not the bank is insured.

The Federal Deposit Insurance Corporation, or FDIC, is an independent government agency that guarantees the safety of deposits held at member banks for amounts up to $250,000 per depositor, per insured bank.

This means your money is safe (up to $250,000 per bank) even if your particular bank goes out of business.

If you have more than $250,000, you could spread it across several banks, limiting the amount at each to $250,000 – FDIC will insure up to $250,000 for each bank. This applies to checking accounts, savings accounts, money market accounts and CDs.

While many/most banks are FDIC insured, they aren’t legally required to be. So it’s a good idea to double check before you set up an account. You can find FDIC insured banks here.

Credit unions are technically not covered by the FDIC, but they have their own insurance through the National Credit Union Administration, or NCUA, which also insures amounts up to $250,000. You can find NCUA insured credit unions here.

Setting up an account

If you’re looking to set up a new bank account, here are a few things to do;

1) Gather your personal information – ID, social security number, and contact information.

2) Decide on the type of account (checking vs savings vs money market, etc).

3) Compare offers. Look into specifics, like fees, account minimums, and interest rates.

4) Apply online, over the phone, or in person. You may be required to make an initial deposit, and some require minimum deposit amounts to get started.

5) Periodically monitor your account, looking out for any changes in service or fees, and any unusual activity.

6) Save money and get rich!

Making payments: Debit vs Credit

No discussion of banking basics would be complete without talking about debit cards and credit cards. While they may seem similar, there is a big difference between the two.

Debit cards are linked to your bank account, allowing you to make purchases directly from your account. Many debit cards also double as ATM cards, and can be used to take money out of ATM machines. But either way, you are only able to access money you have already put into your bank account.

Credit cards, on the other hand, allow you to borrow money. When you use a credit card, the bank will make a payment on your behalf and you’ll then be on the hook to pay them back. And if you don’t pay by the end of the following monthly billing cycle, you’ll be on the hook for interest too, which can get really expensive.

Learning More: If you want to learn more, we have separate guides on Demystifying Credit and an Intro to Debt and Borrowing.

Comparing credit cards

When you’re looking for a credit card, you’ll want to shop around first. Credit card providers compete by offering different interest rates but also by offering rewards, like cash back or points that can be used towards future purchases like airline tickets.

While rewards can be a nice perk, these cards may also charge higher interest rates. So if you don’t pay your balance in full every month, you may be better off with a card that charges a lower rate and doesn’t offer rewards (but you should always strive to pay your credit card in full every month). If you do pay your balance in full every month, finding a card that offers cash back or points can be a good way to get a little something back when you use your card.

If your credit is weak or non-existent, you may have limited options, but some providers specialize in lending to people with little or poor credit history. As is the case with any financial product, be sure to compare offers before choosing one that’s best for you.

Key Take-Aways

1) Checking accounts are designed for everyday use, offering flexibility in accessing your money but typically paying little or no interest on deposits.

2) Savings accounts are better for longer-term goals. They tend to pay higher interest on deposits, but are limited in terms of withdrawing your money.

3) Money market accounts are similar to savings accounts in that they tend to offer higher interest rates on deposits and may have more restrictions on the number of allowed transactions per month. They may also have higher minimum deposit requirements.

4) When comparing accounts, some things to pay attention to are minimum deposit requirements, maintenance fees, overdraft fees, and interest rates.

5) FDIC insurance protects your money, up to $250,000 per depositor per bank, in case the bank goes out of business.

Sign up to see the rest of this article!