The WES Investing Cheat Sheet

By Dan Nastou, CFA

Hello! Just a quick note before we get started. This guide is intended to offer a high-level overview of investing. But we expand on these ideas and more in our Core Content guides on Investing Basics, Investing Returns, Investing Risk, and Investing Portfolios. Our system is free to use, and you can learn more about how it all works here.

With that, let’s talk investing.

No matter where you’re coming from, I’m guessing you already have some thoughts about investing. I’ve had countless conversations with people about it, and it’s just one of those topics that tends to bring out a wide range of opinions (and usually some perceived baggage);

“It’s too risky”

“Just glorified gambling”

“It’s only for rich people”

“Investing isn’t for me!”

Sound familiar? Well, I’m going to ask you to set aside any preconceived notions you may have. Because the truth is, while investing does carry some risk, the stock market can be used for gambling, and investing is appreciated by wealthy people, investing is also a key part of smart money living – when we approach it the right way. And anyone can do it.

Yes we need to be regularly saving money from our paychecks. And yes we need to be careful with our debts. But it’s investing that can take our finances to the next level.

And while it may feel a little daunting to get started, it doesn’t need to be. We’ve broken it down to the basics so you can get on your way and start investing like a pro – or at least like a well-informed retail investor. So let’s get to it.

Here’s what we cover in this guide

Why invest

Are you ready to invest

How to get started

Understanding risk and return

Choosing your investments

Sticking with it

So, why invest in the first place?

These days, it’s easier than ever for us regular folks to open a brokerage account and get started investing. But just because we can do something doesn’t mean we should do it. So why should we want to invest our money?

Well, simply put, to build wealth.

Investing is a way for us to passively grow our wealth over time by putting our own money to work. And this happens through the power of compounding. When you set aside a portion of your income and use it to buy financial assets, like stocks or bonds, your money can now earn money for you. And then that money can earn even more money for you, and then THAT money can earn even MORE money, until, well, you get the idea. Give it enough time and eventually your accumulated gains can significantly overshadow your initial investment.

And the sooner you start, the more potential upside.

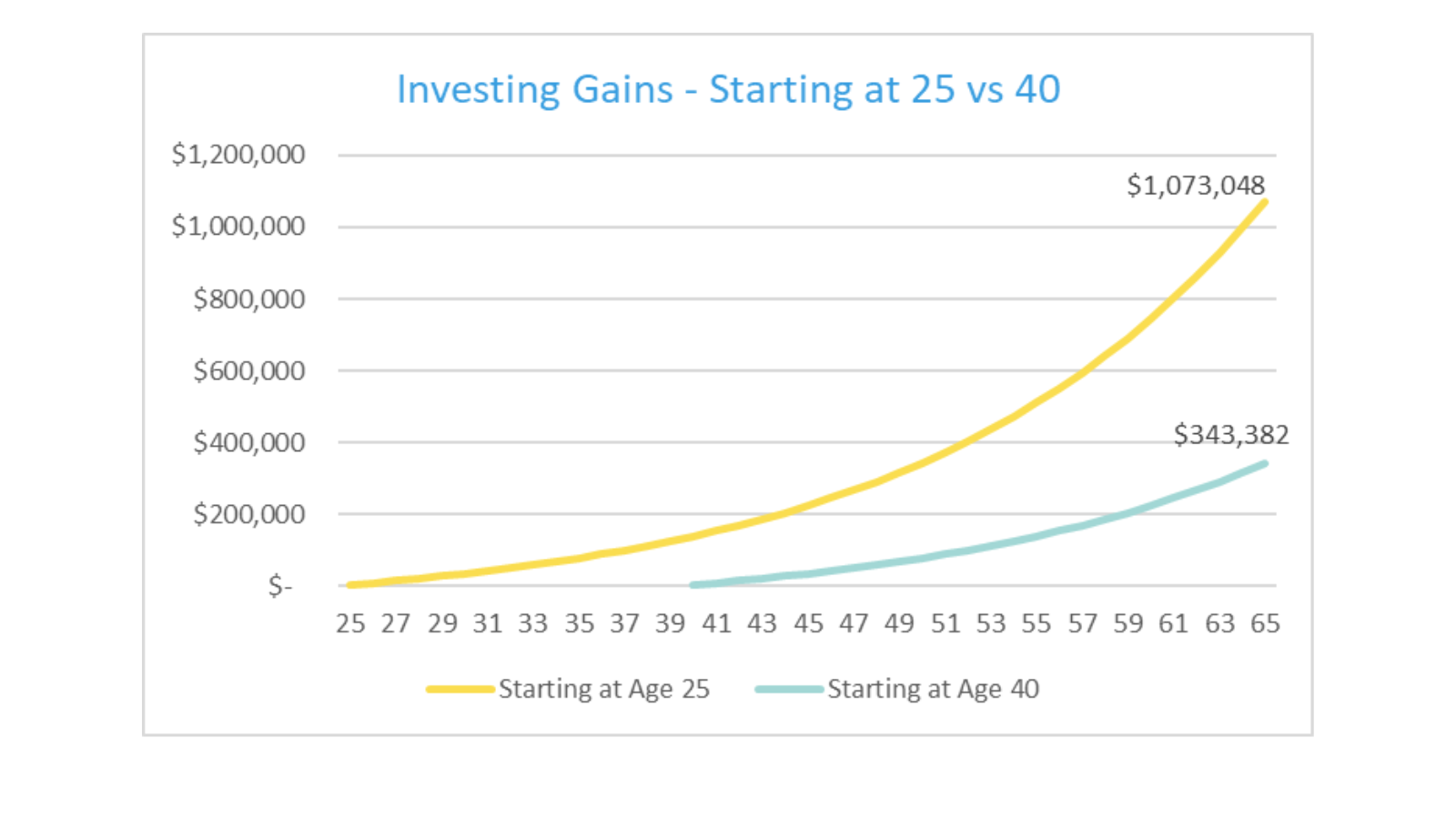

For Example: Let’s say you start investing when you’re 25, and you contribute $5,000 each year to your investment account. And let’s say it earns an annual return of 7% (which is actually a fairly reasonable long-term assumption). By the time you’re 65, your balance will have grown to over $1 million! (And it would be even larger if you increased your annual contributions over the years.)

Instead, let’s say you wait until you’re 40 years old to start. By the time you’re 65 you would have only saved up about $343,000. Here’s what the two scenarios would look like side by side.

Even if you invested $10,000 a year starting at age 40, you would not have caught up (you would have saved about $686,000).

Key Takeaway: Time is a huge factor with investing. So try to take advantage and start investing when you’re young and have many years of compounding ahead. Waiting on the sidelines can cost you a lot down the road (and lead to serious FOMO).

But are you ready to invest?

Generally speaking, the sooner you start investing the better. But there are a few things to consider before you start…

Do you have any high interest debts outstanding, like credit card debt?

Credit card debt and other personal loans typically charge high interest rates, like really high. These rates are almost guaranteed to be higher than what you can expect to earn on your investments. So you’ll almost always want to pay these down as quickly as possible before you make investing a priority.

Do you have some money in your emergency fund?

You always want to have some money put away for emergencies. While the general rule of thumb is to eventually have at least three to six months’ worth of bare bones living expenses on hand, you don’t necessarily need the full amount before you start investing. But you should at least get your emergency fund started with a smaller amount.

Do you have other near-term financial obligations?

Investing is for the medium to long term. And the value of your investments will fluctuate over time. So if you’ll be needing the money in the near term (next few years), you’re probably better off keeping it in a more stable cash account, like a savings account.

How to get started

Feeling good so far? Then it’s probably time to open an investment account. This is where you hold your investments like stocks, bonds, and funds.

There are two basic categories of investment accounts to choose from;

1) Tax-advantaged retirement accounts (401(k)s, 403(b)s, and IRAs): As the name suggests, these accounts offer a tax advantage, which will help your money grow faster than it would otherwise. But there is a downside. For the most part, you can’t take your money out until you reach retirement age. Good for: Retirement savings

2) Taxable investment accounts (brokerages and robo-advisors): These accounts are a bit more basic in that they don’t offer any tax advantage. But they offer more flexibility – you can take your money out at anytime. Good for: General investing

If your employer offers a 401(k) or 403(b), it can be a great way to start investing, particularly if they also offer a match, meaning they’ll contribute money in addition to what you contribute. We can even help you set one up. But again, your money will be tied up until retirement. If you think you may need the money sooner, you’re better off with a brokerage account or robo-advisor.

We should also mention this doesn’t need to be all one or the other. You could contribute a portion of your paycheck to your 401(k) for retirement and also contribute some to a taxable account for more general goals. And you can adjust your contribution amounts over time.

Understanding risk and return

“But isn’t investing risky?” you ask. Well, yes and no. When you invest, you are taking on some financial risk, meaning you can lose money on your investments. In fact, that’s why you get paid to do it, in the form of a return on your investment.

The good news: You can reduce this risk by diversifying, or spreading your money across a number of investments. Any single bad investment will only represent a small portion of your wealth.

The bad news: Diversifying won’t eliminate your risk entirely. The market as a whole will still have its ups and downs (this is called market risk). And the investments that tend to earn the most, like stocks, also tend to fluctuate the most.

However, avoiding investments entirely isn’t necessarily a good idea either. Not only are you missing out on the potential upside we discussed, you’re also taking on inflation risk. Money sitting in a bank account may be safe from the ups and downs of the market, but it probably won’t keep up with inflation. This means it will lose real value over time.

So the key is to strike the right balance. You can use investing to grow your wealth and help protect it from inflation, without taking on more market risk than you can tolerate.

Typically, your age will be an important determining factor here.

When you’re young and have your prime investing years ahead of you, you can generally accept more market risk. If the market goes down, you’ll have more time to recover. And you should be more worried about the long-term effects of inflation. So generally, you’ll probably want to hold more stocks than bonds and take advantage of their higher returns.

As you get older and you have fewer investing years ahead of you, your focus will likely shift toward nearer-term financial stability. So you’ll generally want to hold more bonds and cash.

Choosing your investments

Once you’ve set up your account, it’s time to actually select your investments. This can seem a little tricky, but it doesn’t need to be.

Getting some help: If you’re looking for an easy way to start investing and don’t want to worry about choosing investments or managing your portfolio, then a robo-advisor could be a great choice. They use computer algorithms to automatically select and manage a portfolio of diversified investments for you. And they typically charge a relatively small fee. You can also consider working with a financial professional, but keep in mind that will typically cost more. So you’ll want to make sure you aren’t over-paying for what you’re getting.

On your own: On the other hand, if you’re more of a do-it-yourself investor, then you could probably save a little money by opening a brokerage account and managing your own investments. This takes a little more work, but for some people it’s worth it.

As you think about what to invest in, there are a few general guidelines;

1) Stick to funds – For most people, it’s a better idea to invest in funds – mutual funds and exchanged traded funds (ETFs) – rather than try to pick individual stocks and bonds. Funds are typically invested in dozens or even hundreds of investments, so they’re already diversified, which means you don’t have to deal with the hassle of buying and selling individual stocks or bonds.

2) Watch the fees – Funds vary in terms of what they charge in annual management fees, ranging from around 0.1% – 0.5% for index funds to about 1% or more for actively managed funds. Even small differences in fees can add up to serious money over time.

3) Allocate appropriately – This is mostly about choosing how much you want to invest in stocks vs bonds & cash. Again, your age will probably be a big factor (usually, younger = more stocks, older = more bonds), but you’ll also want to consider other factors, like whether you have any near-term financial needs on the horizon – for example, buying a home.

4) Review and rebalance as needed – While it’s probably not a good idea to check your investment portfolio every day, you’ll want to periodically monitor your investments to make sure they’re still in line with your objectives. This may require rebalancing if your mix of investments has gotten out of whack because certain investments have done better than others.

Sticking with it

Investing works best if you keep at it. So you’ll want to make regular contributions to your investment account(s) and give your money time to grow. Don’t be tempted to spend your gains – remember this money is for longer-term financial goals, it’s not for day-to-day spending.

And be prepared for some ups and downs. As we mentioned, your investments will fluctuate. Some years will be better than average, some worse, but it’s important to stay the course and not let your emotions get the better of you. Have a plan and stick with it. You can do this!

Summary

Whatever your financial goals, investing can be a great way to grow your money and protect it from inflation. The important thing is to get started sooner rather than later so time can work in your favor. If you want to dig deeper, we have you covered, starting with the basics.

This is intended for educational purposes, not financial advice. Talk to your financial professional if you need help or are thinking about making changes to your investments.

Anything else we can help you with?

How to start investing with a brokerage account or robo-advisor

Opening an Individual Retirement Account (IRA)