Investing Part 2 – Returns

About 8 minutes

Investing is about growing and maintaining your wealth. And this happens because you earn a return on your investment. You’re putting your money to work so it can earn even more money for you, like we covered in The Power of Compound Interest.

But how does it actually work? Let’s dig in, starting with stocks.

Here’s what we cover in this guide

Understanding stock returns

Stock return example

Generalized investing returns

Real returns (inflation adjusted)

Expected returns

Historical returns

Understanding stock returns

When you invest in stocks, your return can come from two places;

1) Dividends, which are periodic payments made to you, the owner of the stock

2) The increase (or decrease) in the price of the stock, also called a capital gain (or capital loss)

Dividends will be determined by the management of the company. As a business earns money, management can choose to reinvest it back into the business to grow or can pay some of it out to investors as a dividend. They aren’t required to pay any out though – it’s only if there’s enough money left over after costs and management chooses to pay some out. This is different from bonds, where the periodic interest payments will be set by the bond contract.

But, as exciting as dividends are, it’s the increase or decrease in share price that tends to get all the attention. This is what can earn you a lot of money (or lose you a lot of money) quickly.

Stock prices will sometimes rise, or fall, by large amounts, sometimes even in a single day, resulting in exciting gains or losses. Dividends, on the other hand, will typically just plod along, paying you a slow and steady return over time.

But they’re both important sources of return. So wouldn’t it be great if there was a simple mathy way to combine them? As it happens, you’re in luck.

The total return on your stock investment can be written with this simple equation:

Total return = dividend return + price return

Basically it says your return is the sum of what you earn on dividends and what you earn from changes in the price of the stock.

Let’s do an example with actual numbers to see how it works.

Stock return example

Suppose you buy one share of a stock today for $100.

Let’s say it pays a dividend this year of $3 per share. The ratio of the annual dividends paid to the share price is called the dividend yield, which is 3% in this example ($3/$100 = 3%).

Now let’s say it’s one year later and the price of the stock has increased to $107 per share (because the market thinks it’s now worth $107), and you’ve decided to sell the stock to lock in the gain.

Over the year, you would have earned a total of $10, made up of a $3 dividend plus an increase in share price of $7. You would say your annual return was 10%, which we get by dividing the $10 you earned on your investment by the amount of your original investment, which was $100.

So if we want to put these numbers into that snazzy equation, it would look like this;

Total Return = 3% (dividend return) + 7% (price return) = 10%

And thinking about your return as a percentage of your original investment is key. Let’s say you earned the same $10, but it was on an original investment of $1,000 instead of $100. Your return then would only be 1% instead of 10%. Not as good.

Tax Note: So far we’ve just been talking about returns before taxes. You’ll owe taxes on dividends and capital gains, which will lower your after-tax return. You may also be charged a trading commission when you buy or sell an investment. So you’ll want to factor that in too.

Generalizing beyond stock returns

Alright, so that’s how returns are calculated for stocks, but that equation can be used more generally. For any investment, your return will come from two places;

1) Periodic cash payments

2) Price increase or decrease (capital gains or capital losses)

So no matter what you invest in – stocks, bonds, real estate, whatever – your return will be determined by the cash your investment pays out and the increase or decrease in price.

When you buy a bond, your cash payments will be the periodic interest payments you receive and the price of the bond can also go up or down before you sell it.

Similarly, if you buy a rental property as an investment, your cash payments will be the rent you receive from your tenants. And the price of the property can also go up or down.

Not all investments have both components though. For example, some stocks don’t pay any dividends, so you would rely entirely on an increase in the price for a return. However, your investments should have one or the other, if not both.

What determines price changes?

On any given day, the prices of financial assets like stocks and bonds are determined by financial markets, like the New York Stock Exchange, where buyers and sellers come together to trade. There are actually a lot of different financial markets, but they’re often collectively referred to as “The Market”.

More specifically, prices are determined by the demand of the buyers and the supply of the sellers. More aggressive buying than selling today? Prices will likely go up. More aggressive selling than buying? You guessed it, prices will probably go down. The details are a little more complicated, but that’s the general idea. Supply meets demand.

Over time, the price of a stock should correspond with the change in value of the underlying business. So if the business is doing well, the price of the stock should increase. But this isn’t always the case over shorter periods of time, like days, weeks, or even months when the price changes can be somewhat random.

Key Point: Since your investment return is partly determined by the rise (or fall) in price of your investments, and prices are set by the market, this means the market plays an important role in determining your investment return. We’ll come back to this in the next section on investment risk.

But how much are you really earning?

In addition to thinking about how market fluctuations will impact your investment returns, you also want to consider the impact of inflation.

You’ll want to think in terms of your real return, meaning a return that’s been adjusted for inflation, because that represents how your purchasing power is growing over time, which tells you what your money can actually buy. It’s a more accurate measure of how your wealth is actually growing.

For example: If you earn a return of 5% on your investments this year, but inflation was 3%, your real return is only about 2% (5% – 3%). In other words, even though your account balance has gone up by 5%, everything costs 3% more, so the amount of stuff you can actually buy with your money has only gone up by 2%, not 5%.

Managing your expectations

One of the main points of all of this is to try to estimate how your investments will grow over time. But it’s important to realize that future investing returns can’t be known with complete certainty.

Market fluctuations will impact the prices of your investments, and these fluctuations are unpredictable, especially in the short term.

And even the cash payments (dividends and interest) can’t be know with certainty either. The management of a company may choose to stop paying dividends or to reduce them. A bond could also default and not pay its interest on time or at all.

So because of this uncertainty, we refer to future returns as expected returns.

You can’t be sure what your returns will be, but you can at least make an educated guess. This is important for longer-term financial planning.

Different asset classes will generally have different long-term expected returns.

Typically, stocks are expected to have the highest long-term expected return and cash is expected to have the lowest, with bonds and real estate in between.

So how do you come up with your expectations?

Looking at historical returns

Based on data provided by economist Aswath Damodaran, since 1928, the S&P 500 stock index (which is used to represent the stock market broadly) has averaged returns of about 9.5% per year while 10-Year Treasury bonds (U.S. government bonds) have averaged returns slightly under 5% per year over the same time period.

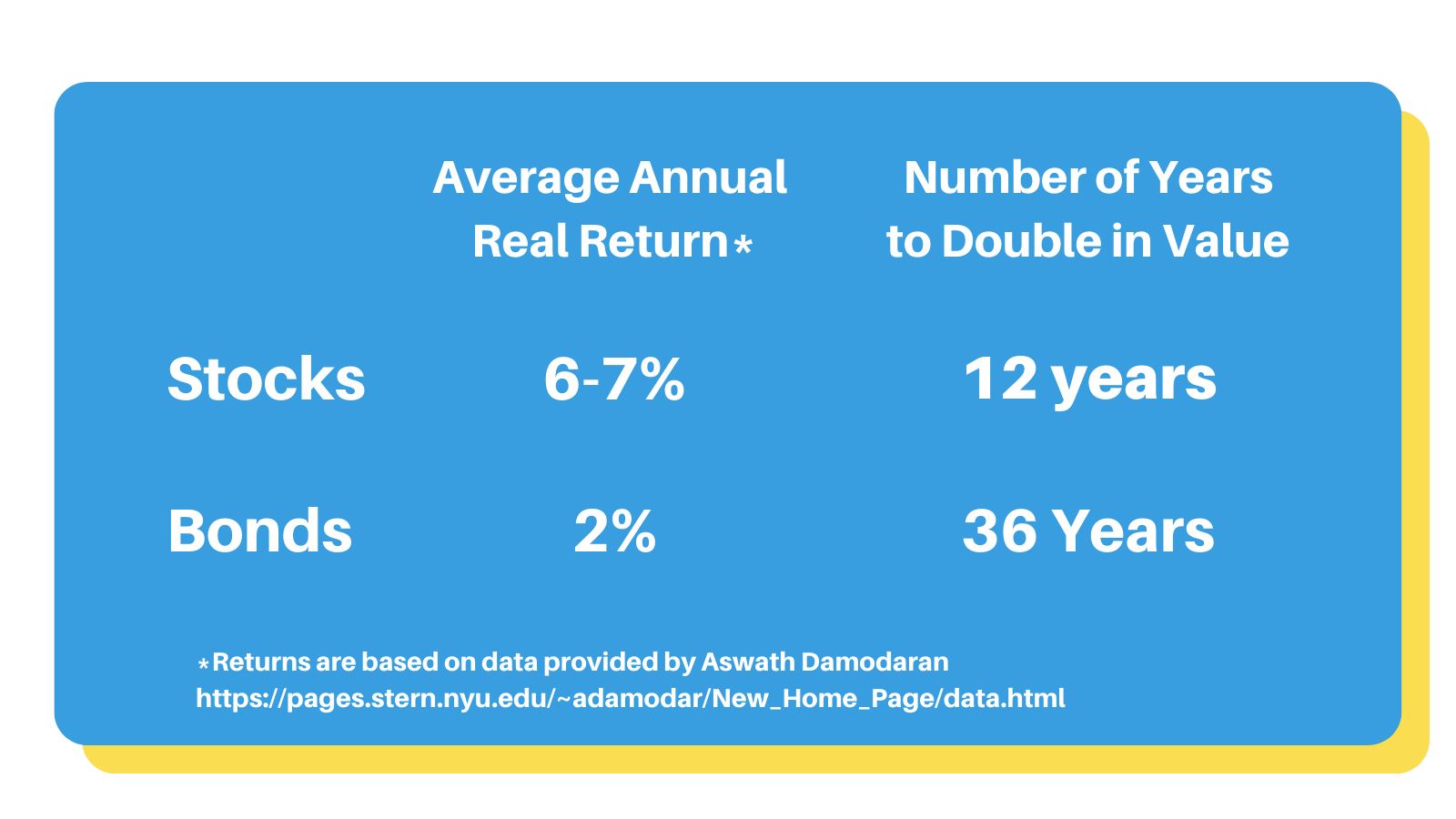

These are nominal returns, so adjusting for about 3% annual inflation, stocks have averaged real annual returns of about 6-7% and Treasury bonds have averaged real annual returns of about 2%.

If your investments are growing at a real rate of 6%, your money would double in value in 12 years. Pretty good!

Mental Math Note: We mentioned the “Rule of 72” in The Power of Compound Interest. To figure out the number of years for an investment to double in value, divide 72 by the interest rate. In this case, 72 divided by 6 is equal to 12 years to double.

For the bonds, which were growing at a real rate of 2%, it would take about 36 years to double. Less good.

Had you owned some stocks and some bonds, your return would have been an average of the two returns, depending on how much of each you owned.

But be prepared for some variability

It’s important to understand that past returns, while a good reference point, are no guarantee of future returns. What you earn on your investments won’t necessarily be the same as what those same investments would have earned in prior years.

And even if you expect stocks to have annual returns of 6% on average, you’ll have years that are above that and years that are below that, sometimes far above or below. Sometimes you might even have several years in a row of below average returns or even negative returns, meaning losses.

We certainly aren’t trying to discourage you from investing in stocks, which do tend to earn strong returns over time, but you need to be prepared for your returns to vary from year to year.

Which brings us to a perfect segue to our next section…Investing Risk.

Key Take-Aways

1) The return you earn on your investments tells you how quickly your money is growing.

2) Investing returns come from 1) cash payments and 2) the increase/decrease in prices.

3) Real returns have been adjusted for inflation and tell you how your wealth has changed.

4) Future returns are uncertain, which is why we talk about expected returns for planning purposes and look to past returns as a starting place for estimating future returns. Since 1928, stocks have earned annual real returns of about 6% and Treasury bonds have earned annual real returns of about 2%.

5) Assets that tend to have higher returns also tend to have higher market risk.

Sign up to see the rest of this article!