Setting Goals and Building Wealth

About 8 minutes

Alright, before we do anything else, we need to talk about setting some goals. We know, some of you are natural goal setting overachievers, and that’s great. But, for the rest of us equally delightful procrastachievers, it takes a little more work. And that’s okay too. A little work never hurt anyone.

Why does this all matter?

While we mostly focus on financial topics around here, we need to keep an eye on the big picture. And we need to remember that money is just a means to an end.

All of this is really about living a good life. But of course to live a good life, we need money. And that means we have to do a little planning to figure out just how much we’ll need.

Life is full of uncertainty though. So chances are you won’t know exactly how much money you’ll need for every stage of it. And that’s okay.

Setting goals and planning ahead is not about calculating down to the very last nickel how much money you’ll need for every moment of your existence. It’s about making reasonable estimates for your future, and creating an equally reasonable plan for your money.

And yes, you might realize you won’t be able to afford the house with the helipad as soon as you thought. But as you spend more time contemplating what really matters most to you, you’ll probably realize those things are all achievable with some planning.

So then, what do you actually do to achieve those dreams? Let’s get to it!

The key to building wealth

If there’s truly one “secret” to building wealth, it’s this – make money, save as much of it as you can, and use it to buy wealth-generating assets. And then keep doing it.

Alright, that’s it, now go do it! Only kidding. Of course the devil is in the details. But that’s the general framework we should be thinking about. If we want to grow our wealth, there are three main levers to work with;

1. How much we earn

2. How much we spend

3. How we invest our savings

Your earning power (#1 above) is clearly important since that’s what generates your wealth in the first place. No earnings means no savings means no wealth to grow. So to the extent you can maximize your earnings potential, you’re going to have that much more room to work with.

In terms of #2 above, how much we spend, this is all about saving the money we earn. We have other guides dedicated specifically to this, so we’ll hold off for now.

Which leaves us with #3.

Acquiring wealth-generating assets

This is probably the least straightforward and, as a result, the least understood of the three levers. So it’s worth digging in.

Technically speaking, an asset is anything that stores value. This would include money in a bank account, physical property, stocks, bonds, mutual funds, or even fancy artwork (although trying to value fancy artwork is a little more opaque).

Ideally though, you should be trying to acquire assets that will also generate wealth, either by producing income or by appreciating in value over time.

That way, your wealth will compound. The more wealth-generating assets you acquire, the faster your wealth grows, which means you can acquire more assets, and….well, you get the idea.

The goal is to eventually accumulate enough assets to be able to live off the income they generate. Of course you might like working, which is great. We should all aspire to that. But it’s good to at least have the option for financial independence if and when you want it. And at some point you will have to retire whether you want to or not.

We should mention though that not all assets are equally effective at storing and generating wealth. For example, while a car is technically considered an asset, it’s less liquid than most financial assets, meaning it could take more time and effort to convert it into cash. Even more importantly though, a car depreciates, which means it loses value over time. And building wealth generally means buying assets that appreciate in value over time.

For the most part, this will include stocks, bonds, and real estate (or maybe owning a business).

You’ll also want to limit your liabilities

While assets may be the star of wealth creation, they’re actually only half of the story. You also need to keep an eye on your liabilities.

A liability is basically the opposite of an asset. Instead of storing wealth, it represents a future cost. This would include your debts and loans, and any other future expense.

Liabilities tend to drain your finances, usually by charging you interest. So for the most part, you’ll want to keep them under control and work towards paying them down.

See where you stand with your personal balance sheet

As you think about your financial future, you’ll want to have a solid grasp of where you stand today. And a helpful way to do this is with your personal balance sheet, which combines your assets and your liabilities into one financial snapshot.

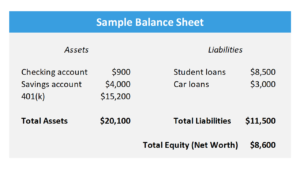

Here’s how to create your personal balance sheet;

1) Make a column listing all of your assets – be sure to include your checking accounts, savings accounts, investment accounts (like a 401(k), IRA, 403(b)), real estate, etc. And write down the value of each. If you don’t know the exact value, use your best guess.

2) Make another column to the right of your assets and list all of your liabilities, including any debts, loans, large unpaid bills, etc. And write down the amounts.

3) Add up your total assets and subtract off your total liabilities.

The difference is your financial net worth, which will be positive if your assets are greater than your liabilities or negative if your liabilities are greater than your assets.

Here’s an example of what this might look like.

Some people put a lot of emotional emphasis on this number, as if we can distill our self-worth into a single entry on a financial balance sheet. Well, that’s not what this is. But it does give us a sense of where we stand financially at any given time.

And it should be pretty clear that if you want to increase your financial net worth, you either need to increase your assets, decrease your liabilities, or ideally do both.

What about owning a home?

If you own your home, we generally would include it on the asset side of the balance sheet – it is a store of wealth and home prices tend to increase over time (although they certainly can fall too).

However, your home deserves a bit more consideration for two important reasons;

1. It’s usually difficult to convert your home into money you can spend. You would have to sell it and find a new place to live, which will take time and cost money.

2. There are costs associated with owning a home, like the interest expense on a mortgage, maintenance expenses, and property taxes. And typically, the more expensive the home, the higher the costs.

So since buying a more expensive home doesn’t really make you wealthier the way having more stocks, bonds, or cash would, you should think of a home as being asset-ish.

In short, it’s part asset, but also part living expense.

Overall, it’s okay to include your home in the asset column, but of course don’t forget to put your mortgage on the liability side too.

Now it’s time to do some planning

After you’ve taken an inventory of your assets and liabilities with your personal balance sheet, it’s time to think about what you want to accomplish with your money.

For the most part, we’ll be covering goals that increase your wealth by either growing your assets or reducing your liabilities.

This might include;

• Paying off your student loans

• Saving for an emergency fund

• Saving for retirement

If you aren’t quite sure what goals are right for you just yet, don’t sweat it. As you explore the rest of our content we’ll go into more detail on these and others, and your own personal goals should become clearer.

And of course you’ll have some other money goals that don’t exactly increase your financial net worth, like saving up for a vacation. These are obviously important too – like we said, money is a means to an end. Just know you’ll need to strike the right balance between these and your wealth-building goals.

Make your goals concrete and set milestones

When you set your goals, you’ll want to make sure they’re specific and actionable with a clear objective in mind. Otherwise it can be challenging to track your progress.

The more specific you can get, the better. For example;

Bad goal (too vague): Save more money for emergencies.

Good goal (specific): Save $2,000 for emergencies over the next 18 months.

Also, if you’re feeling intimidated, try breaking your goals up into smaller “mini goals” and set discrete milestones. This will be particularly helpful when you work on your longer-term goals, like saving for retirement.

Pro Tip: Automating your finances can help ensure you’re making regular contributions to your various financial goals. We have a short guide to walk you through how it works.

What if I have too many goals?

Well, chances are that will be the case. For most of us, there simply isn’t enough money to go around to all of our goals at any given time. So you’ll need to do a little prioritizing.

In general, you’ll want to focus on the most urgent goals first, like building up some emergency savings or paying off credit card debt if you have it.

And don’t get discouraged if you feel like you aren’t making enough progress on all of them at once. Building wealth takes time. Be patient and stick to your plan. You will see progress. We’ll offer some more suggestions on how to prioritize your goals throughout the site.

Schedule time to review and adjust

Of course, setting goals and then completely forgetting about them won’t do you a whole lot of good. This is a case where you do NOT want to “set it and forget it.”

So write them down, like on your phone, or on your computer, or even on a piece of paper if you still know what that is. And schedule some time to review your progress periodically.

A few things to think about as you do;

1. Make sure your goals are still relevant – Life is constantly changing and our financial needs will change along with it. Make any necessary adjustments.

2. Be flexible – You can think of planning as a best guess, but it’s still a guess at some level. Unexpected things will inevitably pop up, some good, some bad. So you should build in a cushion with your estimates and allow for some flexibility.

3. Reflect on your successes – It’s easy to be overly critical of our bad financial decisions, so it’s important to take pride in your wins and celebrate them.

At the end of the day, setting goals won’t transform your financial situation over night. But if you design a sensible plan and stick with it, you will start to see real, life-changing progress.

So keep at it!

Key Take-Aways

1) Base your financial goals on your life goals.

2) Grow your assets, which store and grow wealth.

3) Limit and reduce your liabilities, which must be paid in the future.

4) Set concrete and actionable financial goals and review and adjust them over time.

5) Plan for some uncertainty.

Sign up to see the rest of this article!