What’s the Deal with Recessions and the Stock Market Anyway?

News flash! Warning! Code red! A recession is just around the corner! Or…maybe not.

Actually, no one really knows. But people like to talk about upcoming recessions like it’s the end of the Mayan calendar. However, you may be surprised to learn that a recession doesn’t necessarily spell doom and gloom for you and your finances.

So let’s separate myth from reality and get down to the facts.

First of all, what exactly is a recession?

Informally, a recession is often defined as two consecutive quarters of a shrinking economy, as represented by the Gross Domestic Product (GDP). GDP is a measure of the value of all goods and services produced in the economy. So a declining GDP means the economy overall is shrinking.

However, the technical definition of a recession is a little different.

The National Bureau of Economic Research is responsible for officially declaring when recessions have occurred, which they define as;

“a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

Alright. This definition is a pretty vague. But it basically means a recession is a period of time where the real economy is stagnant or shrinking. Not something we generally want.

How do you know when a recession is coming?

Short answer, you don’t.

Recessions are notoriously hard to predict with any accuracy. In fact, they’re often not officially declared by the NBER until after they’re over. Even the Great Recession of 2008 wasn’t declared a recession until a full year after it had started.

And while there may be certain indicators people look to that suggest a recession may be coming, you need to take such predictions with a grain of salt.

What does a recession mean for the stock market?

It’s usually not great, but probably not as bad as you think.

When we hear the word recession we tend to envision a crashing stock market and financial chaos. And the two worst economic periods in the past 100 years (the Great Depression and the Great Recession) did coincide with major stock market crashes. However this isn’t typically the case.

Often a recession may lead to a weak stock market, with below average returns, yet without a crash. And sometimes, the stock market even grows during a recession.

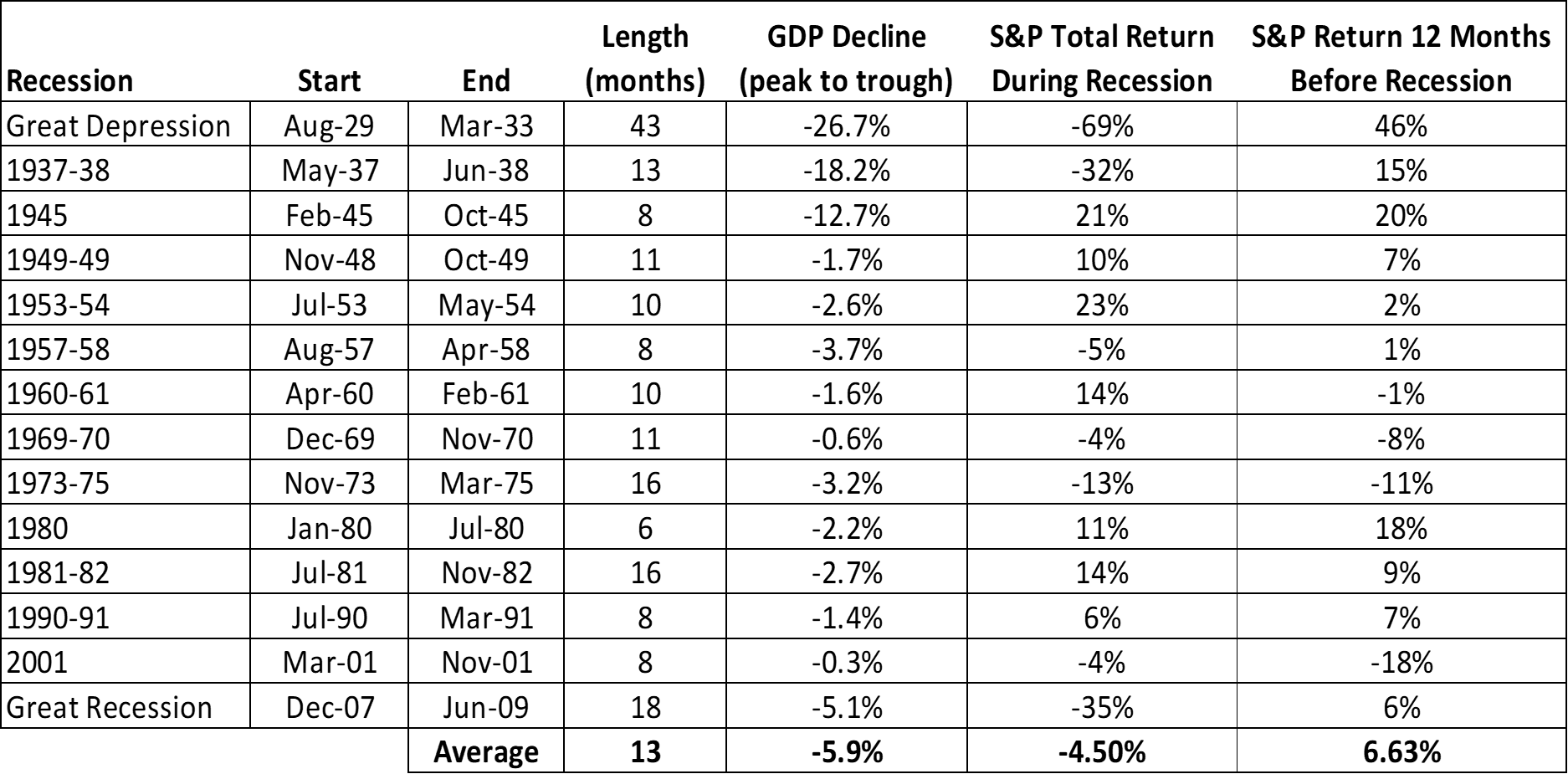

On average, the S&P 500 has only lost about 4.5% during each recession since the Great Depression. (And that average includes very large losses during the Great Depression and Great Recession of 2008).

Perhaps even more surprisingly, in seven of the last fourteen recessions, the stock market actually had a positive return over the course of the recession (meaning stocks increased). And some of those returns were quite large. (See the table below)

The key is to remember that a recession refers to the real economy – how much stuff is being produced. Whereas the stock market represents the collective valuation of publicly traded businesses. Over long periods of time, a growing economy should be reflected in a growing stock market. But these two things don’t need to move together perfectly.

Sometimes stock prices get ahead of the real economy, and sometimes they lag behind. And over relatively short periods of time (even a few years is considered relatively short), the real economy and the stock market might not be that highly correlated.

So what should you do with your investments if you think a recession is coming?

Probably nothing.

As we’ve said, even professional forecasters aren’t good at predicting when a recession will strike. And trying to figure out how long one will last can be just as hard.

Additionally, there’s no reason to expect a stock market crash due to a recession. Not to mention, in seven of the last 14 recessions, stocks have actually earned positive returns – some of them quite large. So at the end of the day, you’re likely better off staying the course and sticking with your long-term investing plan.

Some more fun facts about recessions and stocks

• Since the Great Depression, there have been 14 recessions in the United States. The average length was 13 months and the average return for the S&P 500 was -4.5%.

• Prior to the Great Depression, recessions in the U.S. were more frequent and generally more severe than they are today. Some view this as evidence the Federal Reserve, which was created in 1913, has been able to better manage economic booms and busts.

• The following table is a summary of all recessions since the Great Depression. It includes return data for the S&P 500 which we calculated based on data provided by economist Robert Shiller. Thanks Robert Shiller.

A quick note about the data

We calculated the total returns by using the monthly average prices for the S&P 500 at the start and end of each recession defined by the NBER and included dividends. As you can see, the average return over the course of these recessions was a loss of 4.5%.

We also included the return for the 12 months prior to each recession. Conventional wisdom says the stock market knows when a recession is coming, so the big losses may actually happen in advance of the recession. But based on the data, there’s no clear indication this is true.

Summary

Finally, we should point out there have been only 14 recessions since the Great Depression, which is a fairly small sample size for drawing definitive conclusions. That said, it doesn’t appear that recessions are actually as bad for the stock market as conventional wisdom usually suggests.

So for most investors, the best plan is to stick with your long-term investing strategy, be prepared for some short term bumps, and stay the course.