Why it’s actually not a bad time to think about your finances

Quick Note: If you’ve recently been laid off, we cover that in a separate post.

Alright hear us out. Yes, you’re stuck at home, going a little stir crazy, and have already watched everything on Netflix twice. Yes, your stocks (if you have any) have been on the receiving end of a major beat down (although they’ve come back some). And yes, the economy will likely be in the toilet for the foreseeable future.

BUT, it might actually be a good time to visit your finances (as long as you promise not to panic). Here are a few reasons why.

#1. Interest rates are at/near all-time lows

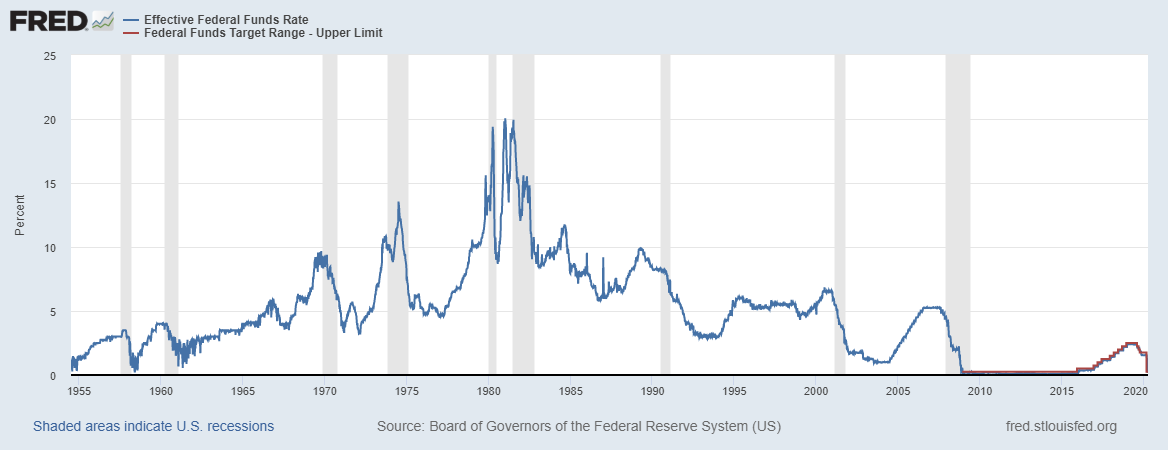

Interest rates have been pretty low for a while now (relative to history), but the Federal Reserve recently lowered short-term interest rates to nearly zero as part of it’s strategy to help the economy during the coronavirus epidemic.

Here’s a sciency looking chart from the Fed website. Note the recent dip to zero.

But before you rush out for free money, this is just the “federal funds rate”. It’s a little technical, but this is the rate banks lend to each other overnight. So, unfortunately it’s not the rate you’ll get on your loans.

However, a lower fed funds rate typically translates to lower consumer rates.

So this means it might be a good time to refinance student loans or a mortgage. It will also work to your advantage if you’re thinking about buying a home, but given the state of the world, there are other challenges you’ll be dealing with there (like how do you buy a home when no one can go outside?).

If you have credit card debt, you can probably get a lower rate on that too, but we always suggest paying that down ASAP because because the high interest rates wreak havoc on your finances.

#2. This could be a good time to invest

First off, it’s been a wild ride for the stock market over the past month. And you don’t want to be refreshing your 401(k)/IRA/brokerage account every 10 seconds. Don’t do that. Stop doing that. Bad dog. Investing is for the long term. And hour-to-hour, day-to-day, week-to-week volatility is part of investing. It may have been noticeably absent over the past 10 years, but it was there, lying in wait, ready to pounce.

Here’s a quick recap of what’s happened in the stock market, looking at the S&P 500.

– Peaked in February at 3393

– Dropped roughly 35% over three weeks (March 23rd), the fastest fall in history

– Proceeded to rally 25+% over the following weeks

– Lot of ups and downs along the way (going down and coming up)

– Currently stands at 2851, 16% below it’s peak

So, what are the key takeaways?

#1. Stocks are still 16% cheaper than they were in February. #2. Stocks can take a WILD and unpredictable ride (and no one really knows what will happen going forward).

Then what should you do?

If you’ve been waiting to invest

Then now might be your time to get in! Actually, any time is really a good time to start investing. Time is a huge factor in your favor. The longer you invest, the more your money will compound and grow. And as we mentioned, stocks are still about 16% cheaper than they were just in February (doesn’t hurt to buy at a discount).

If you want to get started, check out our investing cheat sheet or our post about getting started on a budget.

If you’re already investing

Stick to your plans. You have long-term plans for a reason, and you don’t want to change them up during extreme times – like we’re experiencing now. It’s tempting to try to time the ups and downs, but it doesn’t really work and will most likely cost you more in the end. So hang in there, keep making contributions, and don’t sell in a panic.

HOWEVER, if you’ve found the recent market drop was more than you can stomach, then at some point (once things have settled down a bit) you’ll probably want to revisit your risk tolerance/portfolio allocation for the future.

#3. You want to be sure you’re prepared for emergencies

The third reason to review your finances is so you can make sure you’re prepared for emergencies. Alright, ideally you would have done this before the sh stuff hit the fan, but here we are. The fan has officially been hit.

We generally recommend having at least 3 to 6 months’ worth of spending in your emergency fund – for times just like this.

If you’re just starting out, you may have less, which is alright.

But bottom line, the outlook for the economy is not great at the moment – over 20 million people filed for unemployment in April, and no one really knows when the economy will be firing on all cylinders again. The government is trying to help with the financial relief/stimulus CARES Act, but it’s still hard to know what the future holds. So make sure you have enough cash to get you through what could be a bumpy road for a while.

An opportunity for reflection

Events like this are chaotic and crazy and leave us scrambling to get by. But they also offer opportunities for reflection on what really matters and who we want to be. Money is not the end all be all. Yet it is an important part of life. And financial security takes some work to achieve. That doesn’t mean you need to be perfect, especially in times like this. But if you work on your finances gradually, develop some good habits over time, and stay engaged, even when things are a little rocky, you WILL get to where you need to be.

If you want a little more support, you can sign up for our weekly email updates below, or you can take our free financial health assessment quiz. No judgments here, just some friendly guidance to help you get on your way.

Anything else we can help you with?

► What to do with your stimulus check

► How to start investing on a budget